require(ISLR)

require(MASS)

require(descr)

attach(Smarket)Lab04 Linear Discriminant Analysis Lab

1 Introduction

This document provides a tutorial on using Linear Discriminant Analysis (LDA) to predict stock market directions using the Smarket dataset from the ISLR package. The dataset includes stock market data from 2001 to 2005, and we’ll build a model to predict whether the market will go up or down based on lag variables.

2 Setup

First, we need to load the necessary packages and attach the Smarket dataset.

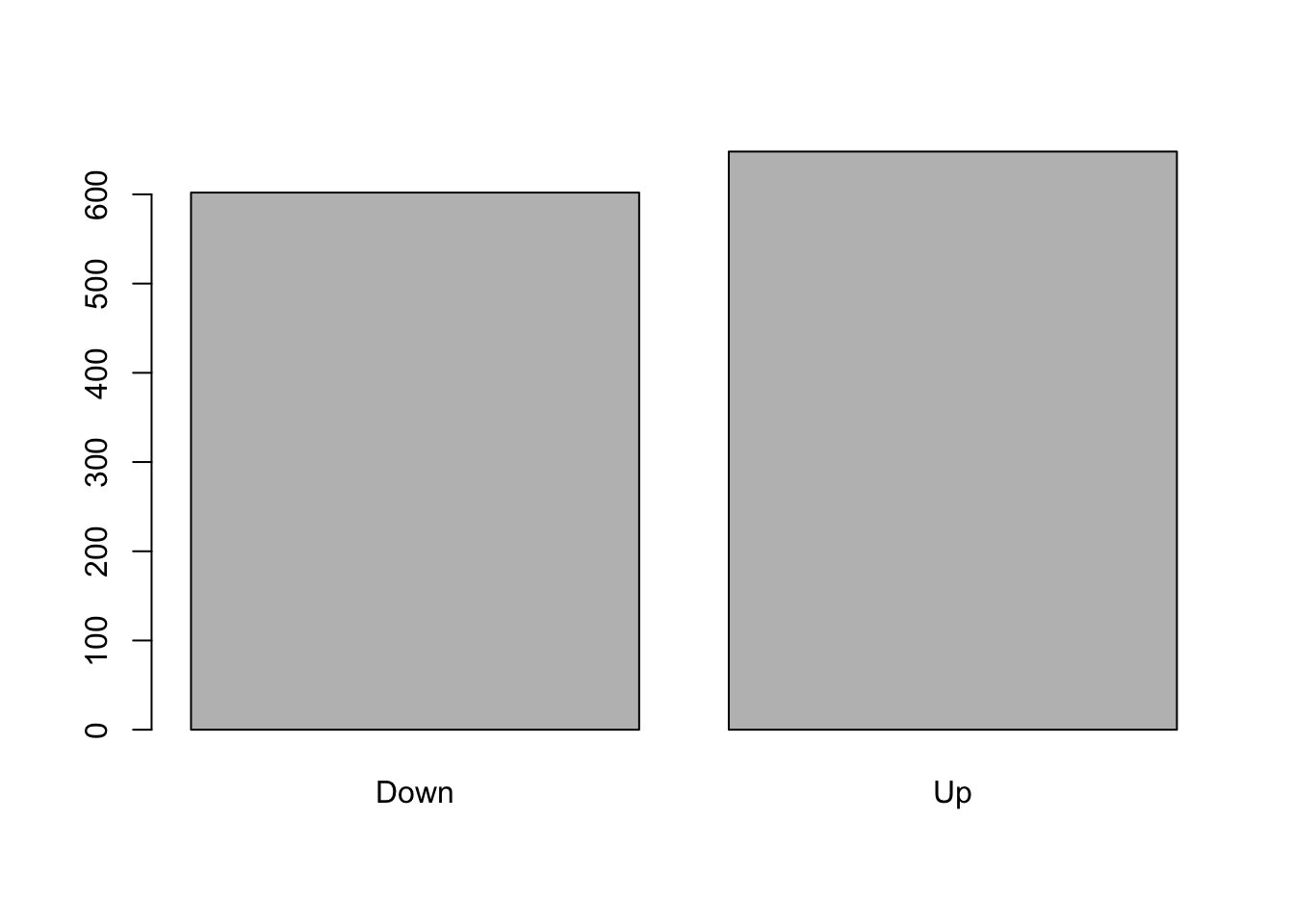

3 Frequency of Market Direction

We start by inspecting the frequency of the Direction variable, which indicates whether the market went up or down.

freq(Direction)

Direction

Frequency Percent

Down 602 48.16

Up 648 51.84

Total 1250 100.004 Linear Discriminant Analysis Model

We now fit a Linear Discriminant Analysis (LDA) model using the Lag1 and Lag2 features to predict the Direction of the market. We’ll train the model using data from 2001 to 2004, and test it on data from 2005.

# Define training data (years before 2005)

train = Year < 2005

# Fit the LDA model

lda.fit = lda(Direction ~ Lag1 + Lag2, data = Smarket, subset = Year < 2005)

# Print model summary

lda.fitCall:

lda(Direction ~ Lag1 + Lag2, data = Smarket, subset = Year <

2005)

Prior probabilities of groups:

Down Up

0.491984 0.508016

Group means:

Lag1 Lag2

Down 0.04279022 0.03389409

Up -0.03954635 -0.03132544

Coefficients of linear discriminants:

LD1

Lag1 -0.6420190

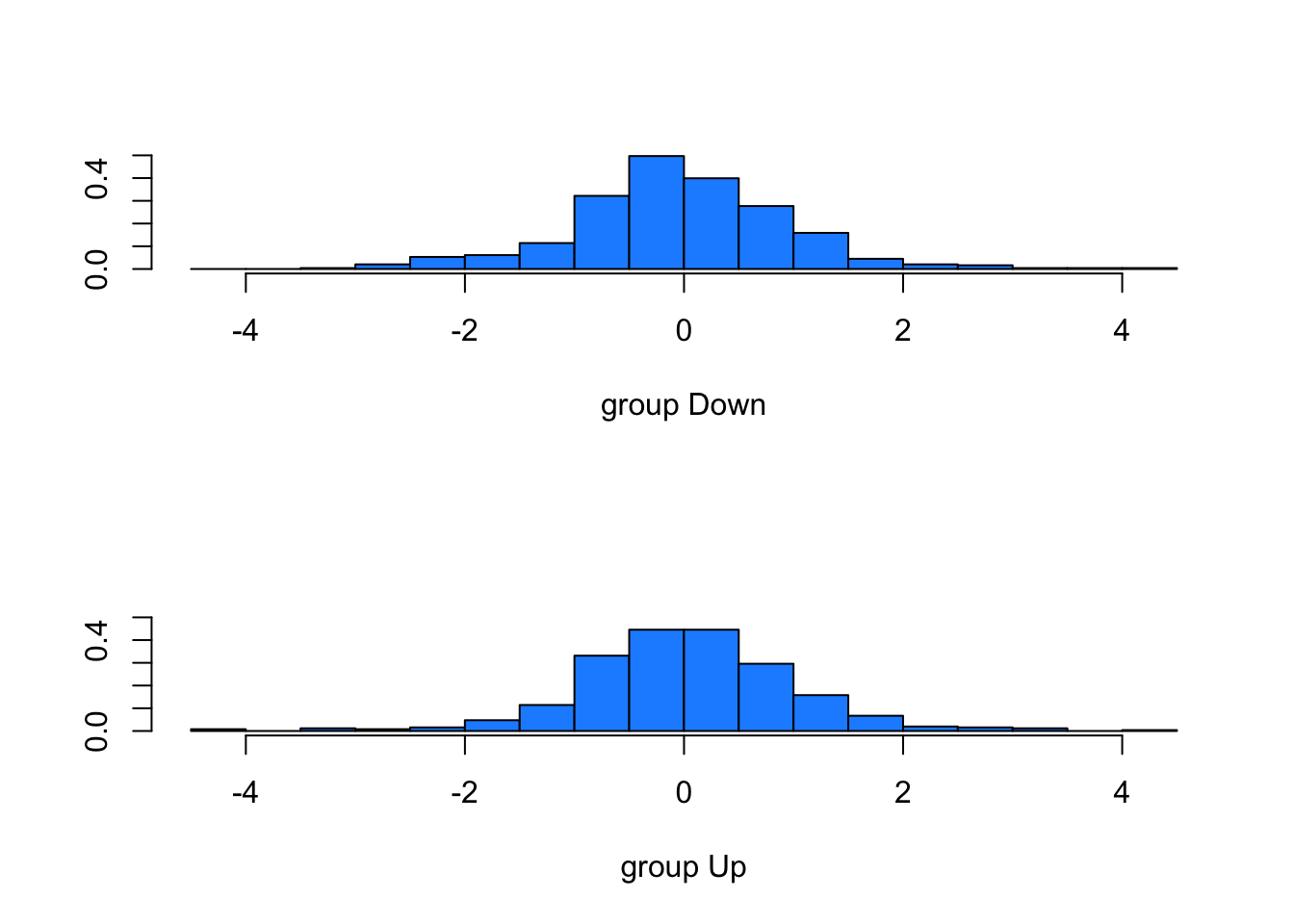

Lag2 -0.51352935 Visualizing the LDA Model

We can visualize the LDA decision boundaries using the following plot:

plot(lda.fit, col = "dodgerblue")

6 Predictions for 2005

Now we create a subset of the data for 2005 and use the trained LDA model to predict the market direction for that year.

# Subset data for 2005

Smarket.2005 = subset(Smarket, Year == 2005)

# Predict market direction using the LDA model

lda.pred = predict(lda.fit, Smarket.2005)

# Display prediction details

names(lda.pred)[1] "class" "posterior" "x" # Predicted classes

lda.class = lda.pred$class7 Confusion Matrix

We can now compare the predicted market direction with the actual direction in 2005 using a confusion matrix:

# Actual market direction for 2005

Direction.2005 = Smarket$Direction[!train]

# Confusion matrix

table(lda.class, Direction.2005) Direction.2005

lda.class Down Up

Down 35 35

Up 76 1068 Model Performance

Finally, we calculate the model’s accuracy by comparing the predicted classes with the actual market direction:

# Display first 5 predictions

data.frame(lda.pred)[1:5, ] class posterior.Down posterior.Up LD1

999 Up 0.4901792 0.5098208 0.08293096

1000 Up 0.4792185 0.5207815 0.59114102

1001 Up 0.4668185 0.5331815 1.16723063

1002 Up 0.4740011 0.5259989 0.83335022

1003 Up 0.4927877 0.5072123 -0.03792892# Accuracy of the LDA model on 2005 data

mean(lda.pred$class == Smarket.2005$Direction)[1] 0.55952389 Conclusion

In this lab, we have implemented Linear Discriminant Analysis (LDA) to predict stock market direction based on lag variables. We used historical data from 2001 to 2004 for training and tested the model on 2005 data. We visualized the LDA decision boundaries, made predictions, and evaluated the model’s accuracy.