# Setup CRAN Mirror

options(repos = c(CRAN = "https://cran.rstudio.com/"))

# Load ISLR package

require(ISLR)Lab06 Logistic Regression Lab

1 Introduction

This document demonstrates how to apply Logistic Regression using the Smarket dataset from the ISLR package. We will explore model fitting, prediction, and performance evaluation using training and test sets.

2 Setup

First, we need to load the required package and dataset.

3 Data Exploration

We will begin by exploring the structure and summary statistics of the Smarket dataset.

# Check dataset structure

?Smarket

names(Smarket)[1] "Year" "Lag1" "Lag2" "Lag3" "Lag4" "Lag5"

[7] "Volume" "Today" "Direction"summary(Smarket) Year Lag1 Lag2 Lag3

Min. :2001 Min. :-4.922000 Min. :-4.922000 Min. :-4.922000

1st Qu.:2002 1st Qu.:-0.639500 1st Qu.:-0.639500 1st Qu.:-0.640000

Median :2003 Median : 0.039000 Median : 0.039000 Median : 0.038500

Mean :2003 Mean : 0.003834 Mean : 0.003919 Mean : 0.001716

3rd Qu.:2004 3rd Qu.: 0.596750 3rd Qu.: 0.596750 3rd Qu.: 0.596750

Max. :2005 Max. : 5.733000 Max. : 5.733000 Max. : 5.733000

Lag4 Lag5 Volume Today

Min. :-4.922000 Min. :-4.92200 Min. :0.3561 Min. :-4.922000

1st Qu.:-0.640000 1st Qu.:-0.64000 1st Qu.:1.2574 1st Qu.:-0.639500

Median : 0.038500 Median : 0.03850 Median :1.4229 Median : 0.038500

Mean : 0.001636 Mean : 0.00561 Mean :1.4783 Mean : 0.003138

3rd Qu.: 0.596750 3rd Qu.: 0.59700 3rd Qu.:1.6417 3rd Qu.: 0.596750

Max. : 5.733000 Max. : 5.73300 Max. :3.1525 Max. : 5.733000

Direction

Down:602

Up :648

# Create a dataframe for data browsing

sm = Smarket

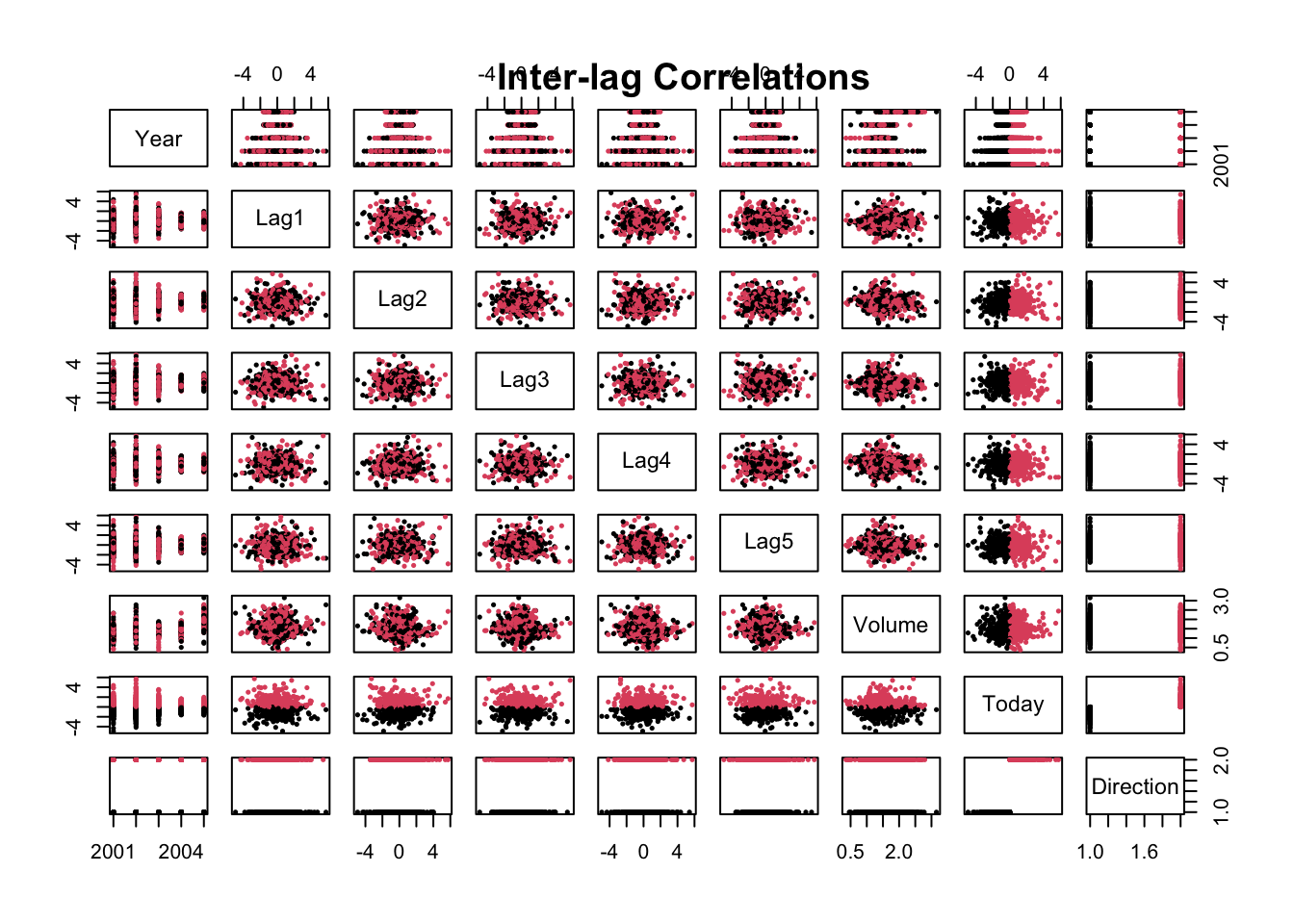

# Bivariate Plot of inter-lag correlations

pairs(Smarket, col = Smarket$Direction, cex = .5, pch = 20)

title("Inter-lag Correlations")

4 Logistic Regression Model

We will fit a logistic regression model to predict the Direction variable (Up/Down) using the lag variables (Lag1, Lag2, Lag3, Lag4, Lag5) and Volume.

# Fit the logistic regression model

glm.fit = glm(Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 + Volume, data = Smarket, family = binomial)

# Display model summary

summary(glm.fit)

Call:

glm(formula = Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 +

Volume, family = binomial, data = Smarket)

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.126000 0.240736 -0.523 0.601

Lag1 -0.073074 0.050167 -1.457 0.145

Lag2 -0.042301 0.050086 -0.845 0.398

Lag3 0.011085 0.049939 0.222 0.824

Lag4 0.009359 0.049974 0.187 0.851

Lag5 0.010313 0.049511 0.208 0.835

Volume 0.135441 0.158360 0.855 0.392

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 1731.2 on 1249 degrees of freedom

Residual deviance: 1727.6 on 1243 degrees of freedom

AIC: 1741.6

Number of Fisher Scoring iterations: 35 Generating Predictions

We can generate predictions from the model and compare the predicted values to the actual market direction.

# Predict probabilities

glm.probs = predict(glm.fit, type = "response")

# Display first 5 predictions

glm.probs[1:5] 1 2 3 4 5

0.5070841 0.4814679 0.4811388 0.5152224 0.5107812 # Convert probabilities to class labels

glm.pred = ifelse(glm.probs > 0.5, "Up", "Down")

# Create confusion matrix to compare predictions with actual values

attach(Smarket)

table(glm.pred, Direction) Direction

glm.pred Down Up

Down 145 141

Up 457 507# Calculate accuracy

mean(glm.pred == Direction)[1] 0.52166 Training and Test Sets

To evaluate the model on unseen data, we split the dataset into training (before 2005) and test sets (2005 data).

# Define training set (before 2005)

train = Year < 2005

# Fit model using training set

glm.fit = glm(Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 + Volume, data = Smarket, family = binomial, subset = train)

# Predict on test set (2005 data)

glm.probs = predict(glm.fit, newdata = Smarket[!train, ], type = "response")

glm.pred = ifelse(glm.probs > 0.5, "Up", "Down")

# Compare predictions with actual 2005 data

Direction.2005 = Smarket$Direction[!train]

table(glm.pred, Direction.2005) Direction.2005

glm.pred Down Up

Down 77 97

Up 34 44# Calculate accuracy on test set

mean(glm.pred == Direction.2005)[1] 0.48015877 Fitting a Smaller Model

To simplify the model, we can fit a logistic regression with fewer predictors (Lag1 and Lag2).

# Fit a smaller logistic regression model

glm.fit = glm(Direction ~ Lag1 + Lag2, data = Smarket, family = binomial, subset = train)

# Predict on test set (2005 data)

glm.probs = predict(glm.fit, newdata = Smarket[!train, ], type = "response")

glm.pred = ifelse(glm.probs > 0.5, "Up", "Down")

# Compare predictions with actual 2005 data

table(glm.pred, Direction.2005) Direction.2005

glm.pred Down Up

Down 35 35

Up 76 106# Calculate accuracy on test set

mean(glm.pred == Direction.2005)[1] 0.55952388 Model Accuracy

Finally, we calculate the accuracy of the model on the test set.

# Calculate accuracy of the smaller model

accuracy = 106 / (76 + 106)

accuracy[1] 0.58241769 Conclusion

In this lab, we have explored logistic regression using the Smarket dataset to predict stock market direction. We fit models using lag variables and volume as predictors, generated predictions, and evaluated model accuracy on test data.